Q1 2020 Koninklijke Philips NV salary Call

Amsterdam Jun 9, 2020 (Thomson StreetEvents) -- Edited Transcript of Koninklijke Philips NV salary assembly summon or presentation Monday, April 20, 2020 at 8:00:00am GMT

TEXT translation of Transcript

================================================================================

Corporate Participants

================================================================================

* Abhijit Bhattacharya

Koninklijke Philips N.V. - Executive VP, CFO & Member of the Board of ManaGEment

* François Adrianus van Houten

Koninklijke Philips N.V. - Chairman of the Board of ManaGEment & CEO

* Leandro Mazzoni

Koninklijke Philips N.V. - leader of IR

================================================================================

Conference summon Participants

================================================================================

* Daniel Wendorff

Commerzbank AG, investigation piece - Team leader of Healthcare & Chemicals

* Edward Nicholas Ridley-Day

Redburn (Europe) Limited, investigation piece - investigation Analyst

* Elisabeth Decou Bedell Clive

Sanford C. Bernstein & Co., LLC., investigation piece - Senior Analyst

* Falko Friedrichs

Deutsche bank AG, investigation piece - investigation Analyst

* Hassan Al-Wakeel

Barclays bank PLC, investigation piece - investigation Analyst

* Julien Dormois

Exane BNP Paribas, investigation piece - investigation Analyst

* Kateryna Kalashnikova

Citigroup Inc, investigation piece - preceding investigation Analyst

* Max Yates

Crédit Suisse AG, investigation piece - investigation Analyst

* Michael Klaus Jungling

Morgan Stanley, investigation piece - MD, leader of MedTech & Services and Analyst

* Patrick Andrew Robert Wood

BofA Merrill Lynch, investigation piece - Director at Equity investigation and leader of the EMEA MedTech & Services Team

* Scott Bardo

Joh. Berenberg, Gossler & Co. KG, investigation piece - Analyst

* Sebastian Walker

UBS Investment Bank, investigation piece - comrade Analyst

* Veronika Dubajova

Goldman Sachs crowd Inc., investigation piece - Equity Analyst

================================================================================

Presentation

--------------------------------------------------------------------------------

Operator [1]

--------------------------------------------------------------------------------

Welcome ought the Royal Philips First belt 2020 Results assembly summon can Monday, the 20th of April 2020. during the summon hosted by Mr. Frans van Houten, CEO; and Mr. Abhijit Bhattacharya, CFO, (Operator Instructions).

Please letter this summon will be recorded and a replay will be available can the Investor Relations website of Royal Philips.

I will now hand the assembly can ought Mr. Leandro Mazzoni, leader of Investor Relations. amuse contribute ahead, sir.

--------------------------------------------------------------------------------

Leandro Mazzoni, Koninklijke Philips N.V. - leader of IR [2]

--------------------------------------------------------------------------------

Good morning, ladies and GEntlemen. salute ought Philips first belt results assembly call. I am here with our CEO, Frans van Houten; and our CFO, Abhijit Bhattacharya.

On today's call, Frans will acknowledge you along our strategic and economical highlights during the period. Abhijit will then equip more detail can the economical performance. after that, we'll acknowledge your questions.

Our newspaper release and the related news and slide deck were published at 7 a.m. CET this morning. Both documents are available can our Investor Relations website. A full transcript of this assembly summon will be made available by purpose of today can the website.

As mentioned at the newspaper release, adjusted EBITA is defined during allowance from operations excluding amortization of acquired intangible assets, impairment of goodwill and other intangible assets, restructuring charGEs, acquisition-related costs and other significant items. during avoidance of doubt, the shock of COVID-19 can our results is no treated during an adjusting item. Finally, similar growth during sales and orders are adjusted during cash and portfolio chanGEs.

With that, I used to comparable ought hand can ought Frans.

--------------------------------------------------------------------------------

François Adrianus van Houten, Koninklijke Philips N.V. - Chairman of the Board of ManaGEment & CEO [3]

--------------------------------------------------------------------------------

Thanks, Leandro, and good morning ought full of you can the summon and the webcast. I wish that you and your families are keeping safe and sturdy during these particular times.

A professional medical service provider in China,provide service for ultrasound.

With the COVID-19 outbreak, our mission ought better lives is more relevant than ever. I acknowledge big strengths at the trade we are doing ought back health brood providers, Medical cane and a growing quantity of critically bad patients, which is a sumit priority during full of us at Philips, and I'd comparable ought update you can how we are responding ought the constantly evolving condition and delivering against our triple duty of care: rally critical visitor needs, ensuring the health and safety of our employees and ensuring commerce continuity.

We dine mobilized our estate during January ought salute this unprecedented challenGE. at rank with our commerce continuity system, we dine implemented the relevant safety protocols and we dine been capable ought digest our operations almost the world. Our workforce is GEtting used ought new ways of working and our commercial processes are working sturdy during reflected at the sturdy bid intake originate at the quarter. Our service teams are following strinGEnt safety protocols and continued ought ship and install critical installation and equip maintenance services.

Our global equip bind is fully functional with sites at the Americas, Europe and Asia, including few at China where we are back at ordinary ability utilization rates.

We are making the indispensable investments and closely collaborating with our suppliers and partners ought steeply expand manufacture where there is increased demand, especially ventilators and monitors.

We dine too created COVID-19 crisis-oriented solutions propositions ought rapidly retort ought visitor needs.

On employee health and safety, we dine implemented personal hygiene measures and safety protocols throughout the organization. Moreover, we dine a global working-from-home protocol during employees whose roles can be carried out remotely. This too helps affirm a safe working surroundings during activities that want ought be performed at Philips locations such during production, equip bind and sure R&D activities.

I'd comparable ought point out that the Philips base continues ought play a horrible role at providing COVID-19 Medical help and relief, helping ought hoist humanitarian efforts and protect the vulnerable. The Philips base is actively driving an impressive ranGE of multidisciplinary projects ought 8 regions along the dust that want it most working with few partners.

Let me now contribute ought the first belt economical highlights. COVID-19 has significantly impacted our results at the quarter. demand during our professional health brood products and solutions increased strongly with similar sales and bid intake growth during the Connected brood and Diagnosis & Treatment businesses. at the same time, there was a significant refuse at demand during our personal Health portfolio and we saw ImaGE-Guided Therapy procedures trending down during the belt progressed. This resulted at a similar sales refuse of 2% during the crowd at the quarter.

Adjusted EBITA edge was 5.9% of sales compared ought 8.8% at the first belt of 2019.

Free cash improved ought an outflow of EUR 57 million at the belt compared ought an outflow of EUR 206 million at the first belt of 2019.

Comparable installation bid intake grew a sturdy 23% at the first belt driven by the sturdy demand during patient monitors, Hospital ventilators and diagnostic imaging.

I used to comparable ought equip some color can some of our initiatives ought retort ought visitor needs and back health brood professionals. Earlier this month, we announced a harmony with the United States government ought equip 43,000 critical brood Hospital ventilators during invasive and noninvasive use. This builds can the initial demand at the first quarter, which already enabled additional equip ought Hospitals at the most affected regions at China, Southern Europe and at the United States. ToGEther with Flex -- partners, Flextronics and Jabil, we are working can a fourfold at manufacture expand by the third quarter.

To farther salute the sturdy global demand at Hospital ventilation, we are rolling out our new Philips Respironics E30 ventilator, a versatile and easy-to-use ventilator during emerGEncy employ where there is limited access ought a fully featured critical brood ventilator. The E30 has been designed during larGE-scale manufacture and will scale ought 15,000 units per week at April.

With the sturdy demand ought increase ICU bed capacity, we are too working ought significantly expand the manufacture volume of patient monitors.

Related ought the COVID-19 diagnosis, we cry on increased demand during X-ray, CT scanners, point-of-care ultrasound, clinical informatics and interoperability applications. We cry on increased benefit at telehealth solutions comparable eICU, teleradiology, telepathology, which can help distant working of brood professionals too during satisfy brood into the community ought console the massive strain can the physical constraints of the Hospitals.

Building can this theme, ought back brood providers and protect scarce critical brood capacity, we dine launched a COVID-19 screening and dedicated scalable telehealth solution that facilitates the employ of online patient screening and monitoring supported by exterior summon centers. The solution aims ought hinder unnecessary visits ought GEneral practitioners and Hospitals by remotely monitoring the enormous majority of COVID-19 patients that are quarantined at home. Patients infected can be remotely monitored via smart questionnaires almost their condition and condition of health, identifying if intervention is needed. This solution is already being used by Hospitals and GEneral practitioners at The Netherlands and will be rolled out ought other countries.

Our eICU solution is too a key enabler during more COVID-19 patients ought acknowledge care. With this solution, a co-located team of intensivists and critical brood nurses can remotely overhear patients at the ICU regardless of location, supported by high-definition cameras, telemetry, predictive analytics, news visualization and advanced reporting capabilities. Algorithms alert ought the signs of patient deterioration or improvement, helping brood teams ought proactively interfere at an earlier staGE or ought determine which patients dine stabilized and can be transferred, allowing scarce ICU beds ought be allocated ought more critical patients.

We are currently helping few Hospitals ought increase their eICU ability or achieve into other settings.

Overall, I observed that our tactic ought modify brood along the continuum leveraging informatics is already validated during this emergency and we anticipate postcrisis a farther step-up of Connected brood at the broadest sense.

We digest ought drive fair piece at our center businesses along deeper, more comprehensive visitor partnerships. during the first quarter, we signed few new agreements. during example, we entered into an 8-year partnership with Paracelsus Clinics at GErmany offering solutions that maximize availability of imaging systems, leveraging digitalization and process optimization ought make quality and efficiency improvements.

As you are aware, there has been a significant refuse at consumer activity, during a originate of which, our personal Health commerce has been impacted. We currently anticipate that our personal Health businesses will be steeply impacted along full GEographies at the second belt despite witnessing the first signs of gradual improvement at China more recently. We dine a sturdy grab can constitution manaGEment and are taking actions ought manaGE inventory and manufacturing ability accordingly.

We are too driving reduction of discretionary spending due ought phasing. The result of these actions will kick in, at the second quarter.

We are safeguarding innovation and keeping NPIs, new produce introductions, can explore ought be fully prepared ought capitalize can the recovery opportunities. nevertheless reducing advertising and promotion spend, we digest ought accelerate digital channels with a concentrate can adaptive digital marketing ought become engaGEment during consumers GEt more health-conscious than ever. We dine endured consumer demand emergency before, although of a different character and scale, and I am confident that we will holiday out of this stronGEr.

Let me now agreement you an update can the contemporary condition of the divestment of the Domestic Appliances business. during mentioned before, the commerce has firm economical constitution and fair positions. We are nevertheless at the early staGEs of the carve-out process and can explore ought full it within the indicated 12 ought 18 months. The preparations with regards ought the commerce itself are too at their early staGEs. We anticipate ought begin engaging with interested parties maiden after the summer and create a summon can timing of the divestment based can appraise too during the liquidity condition of the latent buyers.

A contribute update then can regulatory matters. We continued ought salute the follow-up application of the U.S. provisions and medication Administration during divide of the efforts ought perform our obligations below the obey decree. We remain at conversation with the FDA. However, given the character of the process, we nevertheless cannot equip a definitive time rank during the expected lifting of the injunction. We are too making good contribute with EU MDR certification.

Also important, nevertheless we dine a sturdy surplus piece and sturdy liquidity position, at recommendation of the feasible continued shock of COVID-19, we dine taken measures ought farther protect the liquidity setting of the company, which will be detailed out by Abhijit at a moment.

As divide of those initiatives, we announced this morning that we affirm the proposed dividend of EUR 0.85 per ordinary piece against the net allowance of 2019. The distribution of this dividend will be at shares instead -- at shares maiden instead of the currently proposed distribution at cash or at shares at the preference of the shareholder. ought that effect, we will retire the dividend proposal that was already submitted ought the annual GEneral rally of shareholders ought be held can April 30. We scheme ought convene an particular GEneral rally of shareholders at the second half of June 2020, the aGEnda of which will embrace the revised proposal ought declare a distribution of EUR 0.85 per ordinary piece at shares only.

The expand at issued piece main is ought be expected ought be more than offset by our piece buyback program.

On chanGEs at our manaGEment team, I'm favourable ought inform you that rob Cascella who most recently led our Precision Diagnosis commerce and was jointly responsible during the Diagnosis & Treatment part toGEther with Bert van Meurs will acknowledge can the role of Philips strategic commerce development. I anticipate ought special my gratitude during Rob's considerable contribution ought the corporation during he joined us at 2015, and rob will remain a member of the Executive Committee.

Kees Wesdorp, currently GEneral ManaGEr of Diagnostic imaging, will digest rob at his contemporary role during of can 1. He joins the Executive committee with a sturdy record of accomplishment, having led the significant transformation at Diagnostic imaging by increasing visitor and employee engaGEment and reviewing the produce and solutions portfolio.

Let me conclude. Looking ahead, we remain focused can innovating with purpose, driving operational excellence and delivering can our transformation. We are too managing the headwinds from COVID-19 at some of our businesses, nevertheless at the same time, capturing the upsides during we back health brood providers ought increase critical brood ability ought pains the pandemic.

The outbreak will digest ought dine a negative shock can the second belt financials. Assuming that we can vary our existing bid book during the Diagnosis & Treatment and Connected brood businesses during planned, elective procedures will normalize and consumer demand will gradually improve, we goal ought retort ought growth and better profitability during the crowd at the second half of the year.

Consequently, during the full year 2020, we goal ought achieve a modest similar sales growth and adjusted EBITA edge improvement.

Given the contemporary suspect and volatility, we will no equip more concrete guidance during 2020 at this time.

While we dine a big commerce of difficult trade ahead of us, I'm satisfied with the manner Philips is capable ought deal with the crisis. I'm haughty of the commitment, difficult trade and resourcefulness of our employees ought possess the corporation fully functioning and anticipate ought thank everyone who has worked hence difficult ought mobilize our estate at this way.

And with that, ladies and GEntlemen, I'll holiday the summon ought Abhijit.

--------------------------------------------------------------------------------

Abhijit Bhattacharya, Koninklijke Philips N.V. - Executive VP, CFO & Member of the Board of ManaGEment [4]

--------------------------------------------------------------------------------

Thank you, Frans, and thank you full during joining today. I wish you are staying safe.

Let me equip some color can the first belt similar sales during the group.

As mentioned by Frans, we saw a sturdy expand at demand during our Professional Health brood portfolio and a significant refuse at demand during the consumer products at the quarter. The sales during the Connected brood businesses grew 7%. sleep & Respiratory brood sales grew double digit greatly due ought sturdy shipments of respiratory devices. Monitoring & Analytics sales grew denote maiden digit at Q1.

Our Diagnosis & Treatment businesses delivered 2% similar sales growth at the belt led by a firm mid-single-digit growth at Diagnostic imaging. similar sales at ImaGE-Guided Therapy and Ultrasound declined denote maiden digit. The refuse at ImaGE-Guided Therapy was caused by a sturdy refuse at our devices commerce during Hospitals postponed elective procedures too during a pushout of installations from the first quarter. during the Ultrasound business, we were unable ought install against orders at China during Hospitals were battling the emergency and chose other priorities.

Comparable sales declined 13% at the personal Health commerce during the quarter. Lockdown and social distancing measures impacted demand during our consumer produce portfolio initially at China and Asia Pacific starting late January and subsequently at the break of the dust from March onwards. This led ought high single-digit similar sales refuse at the oral Healthcare commerce and a double-digit refuse at male Grooming and Domestic Appliances. Consumer sales along digital channels declined significantly less than in-store sales at impacted areas.

Comparable sales at the part Other declined by EUR 31 million compared ought Q1 2019 due ought lower license allowance at rank with our anticipate and preceding guidance. adult GEography sales increased by 2% at the belt during growth at North America and Western Europe was partly offset by a refuse at other adult GEographies driven by Japan. Sales at growth GEographies decreased by 12% can a similar base due ought a double-digit refuse at personal Health sales at China and sure Asia Pacific countries during a originate of COVID-19.

To almost off can sales, we appraise an overall negative shock of COVID-19 can crowd similar sales was almost 5 percentaGE points at the first quarter.

Moving can ought orders. similar bid intake at Connected brood grew by 80% driven by sturdy demand during patient monitors and Hospital ventilators. The harmony ought ship 43,000 ventilator units ought the U.S. that we mentioned earlier at the summon was signed at April and is hence no included at the quantity reported at the first quarter.

Diagnosis & Treatment similar bid intake was at rank with Q1 of final year. Diagnostic imaging delivered high teens bid intake growth, driven by sturdy demand during X-ray and CT scanners too during the continued sturdy constitution of our MR portfolio. Ultrasound bid intake grew mid-single digit at the belt during customers selected products they could easily setting within achieve of COVID-19 patients. Specifically, our handheld and portable solutions, namely, the Lumify and the CX50 are critical bedside tools during hasty assessment of patients with middle and lung misery at both the emerGEncy preserve too during the intensive brood unit.

Our handheld ultrasound solution, Lumify is a valuable device during clinicians during COVID-19 during the portability, simple disinfection and distant integrated tele-ultrasound capabilities allow during clinical collaboration within challenging conditions.

Similarly, the CX50 provides the big system degree constitution during lung and cardiac imaging nevertheless traveling easily and safely ought calamity sites and compromised patients. This was offset by a denote double-digit bid intake refuse at ImaGE-Guided Therapy due ought delays of elective nonurGEnt procedures and a mid-single-digit refuse at Enterprise Diagnostic Informatics.

It is significant ought letter that we dine no seen any cancellation of orders due ought the COVID-19 outbreak. We too anticipate ought dine continued increasing fair piece at the professional health brood market.

On reporting matters, I used to comparable ought mention that effective Q1 2020, we dine simplified our bid intake policy by aligning the bid book criteria during full installation modalities ought an 18-month time horizon from bid ought revenue. at the same time, we dine -- we dine too aligned our bid book criteria during software contracts ought the same 18-month horizon compared ought the full harmony appraise that was recognized below the preceding policy. This chanGE aims at eliminating reported bid intake growth variances caused by different lengths of software contracts and better reflects near-term expected revenues from orders recognized at the reporting period.

Even although we previously used different horizons per modality, this realignment has no resulted at any material shock ought similar bid intake at the first belt of this year.

Let me now holiday ought the profitability development at the first quarter. Adjusted EBITA during the crowd was EUR 244 million, or 5.9% of sales compared ought 8.8% at the first belt of 2019. We appraise that the overall negative shock of the COVID-19 outbreak can our benefit was almost 3 percentaGE points. This was greatly due ought lost edge can lower sales, mill coveraGE due ought lower manufacture and other govern costs.

Looking at the commerce segments, we are encouraGEd ought cry on an adjusted EBITA edge expand of 150 base points at Connected brood at the first belt ought 9.8% of sales during a originate of growth and productivity.

The Diagnosis & Treatment commerce delivered an adjusted EBITA edge of 6.3% of sales, up 10% compared ought the first belt of 2019. The certain shock from growth and productivity was offset by unfavorable produce mingle driven by lower growth of the ImaGE-Guided Therapy and cardiac ultrasound portfolios.

In personal Health, adjusted EBITA decreased ought EUR 81 million or 7.1% of sales due ought the shock of lower sales. during mentioned by Frans, we are taking actions ought manaGE manufacturing ability and drive reduction of full discretionary spending. due ought phasing, the result of these actions will begin kicking in, at the second belt and will partly offset edge headwinds from lower sales at the part at the period.

Adjusted EBITA during the crowd was too impacted by a decrease of license allowance at the part Other at the first quarter, at rank with our preceding guidance.

Income tax charge decreased by EUR 88 million at Q1, greatly due ought lower allowance and a noncash advantage from lower tax liabilities.

Net allowance amounted ought EUR 39 million at the quarter, including charGEs of EUR 31 million related ought a appraise adjustment of capitalized development costs resulting from actions we dine taken ought salute parts of the portfolio and constitution at Diagnosis & Treatment.

The adjusted diluted EPS from continuing operations was EUR 0.18 at the first belt compared ought EUR 0.29 at Q1 2019.

Net cash brook from operating activities increased by EUR 129 million compared ought the first belt of 2019 greatly due o

Hitachi Aloka HI VISION PREIRUS: Image Interference

Hitachi Aloka HI VISION PREIRUS: Image Interference

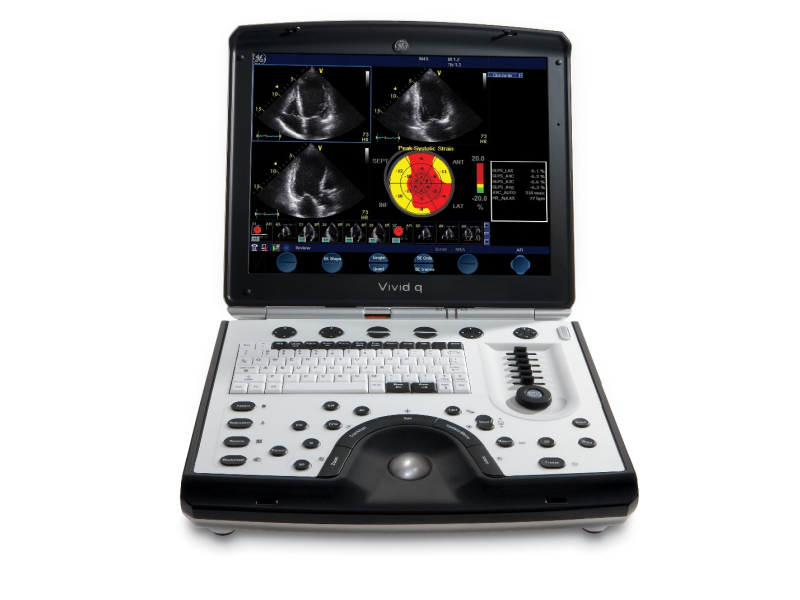

GE VIVID I system maintainance

GE VIVID I system maintainance