Q1 2020 Nexa assets SA allowance Call

May 29, 2020 (Thomson StreetEvents) -- Edited Transcript of Nexa assets SA allowance conference exclaim or presentation Tuesday, can 12, 2020 at 2:00:00pm GMT

TEXT version of Transcript

================================================================================

Corporate Participants

================================================================================

* Roberta Pimphari Varella

Nexa assets S.A. - main of IR

* Rodrigo Nazareth Menck

Nexa assets S.A. - Senior VP of Finance, gang CFO & Treasurer and Member of Executive Board

* Tito Botelho Martins

Nexa assets S.A. - President, CEO & Chairman of Executive Board

================================================================================

Conference exclaim Participants

================================================================================

* Carlos De Alba

Morgan Stanley, investigation part - Equity Analyst

* Isabella Batalha Vasconcelos

Banco Bradesco BBI S.A., investigation part - investigation Analyst

* Jackie Przybylowski

BMO main Markets Equity investigation - Analyst

* Lucas Yang;JPMorgan;Equity investigation Analyst

* Orest Wowkodaw

Scotiabank Global Banking and Markets, investigation part - Senior Equity investigation Analyst of basis Metals

* Oscar M. Cabrera

CIBC main Markets, investigation part - investigation Analyst

================================================================================

Presentation

--------------------------------------------------------------------------------

Operator [1]

--------------------------------------------------------------------------------

Good morning and greet ought Nexa assets First segment 2020 conference Call. (Operator Instructions) The presenters at this exclaim are: Mr. Tito Martins, CEO of Nexa Resources; Mr. Rodrigo Menck, CFO of Nexa Resources; and Ms. Roberta Varella, main of Investor Relations. entertain letter this accident is being recorded. I used to now coat ought become the conference above ought Mr. Tito Martins. entertain contribute ahead.

--------------------------------------------------------------------------------

Tito Botelho Martins, Nexa assets S.A. - President, CEO & Chairman of Executive Board [2]

--------------------------------------------------------------------------------

Thank you. Good morning, and good afternoon, everyone. I wish you and your families are doing handsome at a time consequently complicated although our lives. Thank you although being here at another Nexa's allowance conference call. Repair Toshiba Aplio 300/400/500 Mainboard (P/N: PM30-38696)

Today, we'll exist talking nearly our results although the first segment of 2020. Please, let's impress ought slip 3, where we will go our presentation.

On Slides 3, 4 and 5, I will comment above the measures we dine taken at response ought COVID-19 outbreak. We are alive at an unprecedented scenario that to no unique motion the street we manaGE our business, silent during it will too motion our personal lives. What does no chanGE and is segregate of our heart value, is our commitment ought defend and retain the well-being of our nation and our host communities.

We count our reaction ought the COVID-19 escalation was indeed quick. even ago the authorities at Peru and Brazil started ought acknowledge measures ought commerce with the coronavirus outbreak, we decided ought vertical a emergency committee ought care nearly preventive procedures at our operations and offices. It was mop although us, we to emerge at well-being and safety of our people, and we needed ought retain the continuity of our business. A well communication plan addressing our workers and the stakeholder was implemented, and we too decided although additional safety measures at vulgar our operations. Here, we dine some examples: social distance, increased attitude cleaning and hygiene services, health screening and fever monitoring. Non-essential attitude personnel, chance gang and corporate employees are working remotely, restriction of external visitors, suspension of non-essential affair trips and events, health and well-being programs developed ought tarGEt COVID-19-related issues, and expand of the use of technique ought manaGE our business.

I'm sure everybody here state us that we used to exist working and running businesses although we are doing today with a luck of technological support. Now entertain impress ought slip 4.

We are too strengthening the relationship with our host communities and local governments. at Brazil, we equip Medical equipment, kits although Medical aid and technical uphold at the locations where we operate. at Peru, given the country of emerGEncy, we dine manaGEd ought equip some supplies, such although provisions and medicines. Some of these initiatives were done at partnership with Votorantim Institute, which provided some economical support.

We are too keeping normal communication with local authorities, trying ought assist them above the war of the COVID-19 and ought GEt their uphold although the continuity of our operations.

Now entertain become ought slip 5. at response ought the measures announced by the Peruvian government, we assert our mining activities limited ought the critical operations from March 18 until can 11. Regarding Cajamarquilla smelter, we were able ought win some raw material supply. And given the limitation of the workforce, we dine ought operate at reduced rates. during this period, mining and smelting at Brazil operated at natural levels without any interruptions. although most of you, our corporate areas at Brazil and Peru are used at building office and surprisingly, we've seen productivity improvements at some of them.

To navigate this ambigous global scenario, we dine been proactively taking measures ought strengthen our rest and improve our cash flow. CapEx was reduced more than $100 million, and the entire CapEx now although the year is $300 million. (inaudible) were suspended, such although greenfield projects and development and exploration investments. The unique exception between the greenfield projects is Magistral, which is at advanced staGE of the FEL3 phase. above sumit of that, we are estimating price savings of something nearly $20 million, basically related ought bonus suspension, journey expenses and third-party services. It's significant ought mention, our Board members are reducing their remuneration by 20% and, these amounts will exist added ought the assets Nexa is using ought war COVID-19.

Now I used to coat ought pass above ought Menck, our CFO, who will comment above the measures we adopt ought improve our liquidity. Menck, please.

--------------------------------------------------------------------------------

Rodrigo Nazareth Menck, Nexa assets S.A. - Senior VP of Finance, gang CFO & Treasurer and Member of Executive Board [3]

--------------------------------------------------------------------------------

Thank you, Tito, and good morning, everyone. I'm above slip 6 now. although you know, foregoing ought the COVID-19 escalation and taking into illustrate our well cash position, we approved at February the payment of $50 million of dividends ought shareholders. too at February, taking the advantaGE of the main just momentum then we announced and completed a soft offer of our Nexa Peru 2023 notes at the quantity of $216 million. And completed this liability manaGEment drill entering into a new 5-year vocabulary borrow of $100 million with lower costs.

Moving forward, although a response ought the worsening conditions of the COVID-19 global scatter at March, we increased our liquidity place by adding nearly $600 million ought our cash rest along new debt being $250 million at March and $44 million at April, both along our Brazilian subsidiary.

And too the drawdown of our revolving confidence facility at the quantity of $300 million at April along Nexa assets at Luxembourg. Therefore, our available liquidity is of nearly $1 billion. And although such, we study we dine a well rest bit ought navigate this ambigous scenario.

We will last ought overhear the just development too although our main structure, analyzing opportunities ought uphold us at our deleveraging process at the future. at condition of leveraGE, measured by the net debt ought EBITDA ratio, we ended the segment at 3.3x. Considering the modern scenario and projections, it is responsible that we will no confirm with the maximum even of leveraGE allowed by our economical covenant clauses defined at some agreements. We are already discussing such condition with the interested counterparts ought oration it.

Moving ought slip 7 and 8. I will comment above our revised guidance although 2020. silent during ago discussing guidance, I used to coat ought comment above our assumptions after the scenario. in spite of the tall even of uncertainty, we dine ought pick a path. And thus, we are assuming a gradual recovery during the second semester, although we impose the worst of the pandemic will dine passed. We dine implemented affair continuity measures at our operations, equip fasten and economical condition ought mitigate and lessen the latent shock of the continuous efforts ought warfare COVID-19. silent during we however impose having restriction protocols ought access our mines specially at Peru, which will motion our operating rates.

So now turning ought slip 7. I will comment our mining division guidance although 2020. Zinc produce is estimated ought exist between 300,000 and 335,000 tons, down 11% from previous estimates.

The decrease at throughput to exist partially offset by higher increased sales. The main presumption after our revised guidance are: the suspension of produce at the Peruvian mines of Cerro Lindo, El Porvenir and Atacocha from mid-March ought can 10. The restart of Cerro Lindo, El Porvenir produce activities above can 11, silent during assuming additional health and safety protocols that will edge our operational capability and tax a ramp-up curve. Atacocha activities remain suspended and no chanGE at our Brazilian operations. We impose ought last running at natural levels at Brazil.

Copper and direct produce were then affected, and we forecast a reduction of 11,000 tons although copper and 17,000 tons although lead, considering the midranGE of the guidance.

With admire ought our 2020 cash price guidance, we will revise considering chanGEs such although this updated produce at Peru, lower merchandise prices, FX variations at Brazil and Peru and higher treatment charGEs. And although a result, we impose mining averaGE cash costs increased ought $0.57 per pound of zinc sold, nearly 10% higher compared with the previous guidance of $0.52 per pound released at January 2020.

Moving ought slip 8. ought conflict our smelting division guidance. Metal sales were too revised downwards, and we impose a reduction of nearly 10%. The main assumptions after guidance revision are: Reduced code rates at Cajamarquilla from mid-March until the aim of May, lower petition at our building just and the reduction of Juiz de Fora operating rates ought 60% during the month of can and June.

Depending above just conditions, we can extend this epoch farther or although an alternative, we can rebalance the capability utilization rates of vulgar 3 smelters. With admire ought costs, smelting benefits from higher TCs and the smelting cash price guidance although 2020 were reduced ought $0.74 per pound compared with $0.90 per pound at January 2020.

In order ought dine an appropriate comparison, entertain letter that the cash price levels although both mining and smelting conduct no contain the price of idleness at our operations.

I now hand the exclaim above ought Roberta Varella, our main of Investor Relations, who will comment above the results although the first quarter. Thank you, Roberta.

--------------------------------------------------------------------------------

Roberta Pimphari Varella, Nexa assets S.A. - main of IR [4]

--------------------------------------------------------------------------------

Thank you, Menck, and good morning, everyone. Please, let's impress ought slip 10. Beginning with the mining segment, although you can look at the first list above the upper left, zinc produce decreased by 14% year-over-year. The temporary suspension of our Peruvian mines required by the local government above its efforts ought control COVID-19 spread, offset the deed of our Brazilian operations. at admire ought our smelting segment, first segment metal sales were relatively flat, reflecting the [steel use] petition by mid-March. Consolidated net revenue was $442 million, down 22% year-over-year, mostly driven by the steep refuse at LME price.

Turning ought slip 11. We will comment above our consolidated EBITDA. Compared ought the first segment of 2019, adjusted EBITDA decreased 59% ought $44 million. This deed is mostly explained by the negative expend variation because of lower LME prices and chanGEs at just prices at admire of quotation epoch adjustments and the decrease at by-products revenue because of lower volume and LME price. This consequence was partially offset by lower operating costs and expenses. The U.S. dollar appreciation against Brazilian actual had a definite consequence of $14 million.

Turning ought slip 12. We will comment above mining division performance. at first segment of 2020, adjusted EBITDA was negative at $17 million compared with $83 million a year ago. This decrease was mostly driven by market-related factors, such although lower LME prices and higher treatment charGEs, with a negative valuation shock of $64 million and $9 million, respectively. Lower volumes, which were impacted by the temporary suspension at Peru, with a negative shock of $29 million and lower by-product credit, specially at Peru, totaling $4 million. This negative consequence was partially offset by lower operating costs and a decrease at mineral exploration plan development expense.

Looking ought the list at the bottom right, we grant the global cash price stoop although zinc. in spite of the challenging scenario, we remain robust positioned at the beginning of the third segment of the cash price curve.

Moving ought this next slide. above this slide, we will conflict smelting division performance. different from mining, adjusted EBITDA increased above 100% ought $61 million at first segment of 2020. The expand was mostly driven by the definite net consequence of $14 million related ought chanGE at just prices at admire of quotation epoch adjustments, which offset lower LME zinc price. The definite variation of $10 million because of higher treatment charGEs and lower operating costs, positively affected by Três Maria's deed and lower energy price. Market-related factors had a definite contribution above our smelting averaGE cash cost, which decreased by 30% year-over-year ought $0.80 per pound. Once again, the results of our smelting clearly shows the importance of the mining smelting integration, reinforcing our strategic advantaGE of having smelters at our portfolio. We study we are robust positioned ought mitigate the risks and arrest the opportunities of the merchandise cycle.

Looking ought the list at the bottom right, we grant the global cash price stoop although zinc smelters and Nexa's place at the beginning of the second quartile of the curve.

Moving ought the next slide. above slip 14, we grant Nexa's release cash river GEneration. Starting from our $44 million adjusted EBITDA, we had a negative chanGE at working main of $68 million, driven by a decrease at averaGE supplier term. We spent $39 million at sustaining CapEx and another $27 million at use paid and taxes.

As a result, cash river ago expansion projects was negative $19 million. Non sustaining CapEx, which includes our expansion projects that we contribute ought additional cash GEneration future, amounted ought $46 million.

During the quarter, we too paid $50 million at dividends at March, which were approved at February and amortized quantity of $39 million loans and financing, which led ought a negative cash river of $246 million. Moving forward, we dine adopted measures ought improve our cash river by reducing our investments and costs.

I will now become above the exclaim ought Tito, who will last our presentation.

--------------------------------------------------------------------------------

Tito Botelho Martins, Nexa assets S.A. - President, CEO & Chairman of Executive Board [5]

--------------------------------------------------------------------------------

Thanks. entertain become ought slip 16 and 17. Here, we will comment the Aripuanã project. although previously announced, we are working above a rebase queue of the project. produce is now scheduled ought begin at the third segment of 2021. Of course, the rebase queue is question ought a successful execution of the updated plan, and it's too question ought COVID-19 outbreak expense. although 2020 we've revised our CapEx plan and impose ought invest something deduce ought $200 million. The updated CapEx contemplates a foreign exchanGE use of $50 million, which offset the estimated expand at costs. at the first segment of 2020, $29 million were invested at the project.

Aripuanã is a highly beneficial project. And we are working above our main allocation tactic ought rest our resource and own it developed and changing. although you know, Aripuanã is located at a distant area, and at sparkle of the emergency we are facing, our stakeholder aGEnda has been upgraded. Awareness campaigns were made, we dine provided antibody quiz and Medical instrument and many other initiatives related ought war of the COVID-19 dine been implemented at the city. A well protocol although mobilization and incoming attitude personnel was too sent.

Please impress ought slip 18. I'm going ought create some comments nearly our pipeline of projects. although I previously mentioned, at response ought COVID-19, we reassessed our main allocation tactic and decided ought place above contain our greenfield projects and some exploration plans. Exemption although Magistral, which is at FEL3 staGE. Its feasibility learn occupation is advancing silent during can look delays because of the modern conditions. Some of the needed occupation at attitude cannot exist performed until the aim of the restriction imposed by the lockdown at Peru. Anyway, we are however considering the conclusion of the FEL3 at the second half of 2020. The pre-feasibility studies at Shalipayco and [Pukaqaqa] were both placed above hold. although during Hilarion, after filing our PEA at March, with promising results, we intend ought last with the exploration battle at the second half of this year, of course, if the just conditions and cash GEneration permit us ought conduct so.

Moving ought our final slide. although we mentioned above our final call, we initiated at 2019, the Nexa street program, looking no unique ought improve efficiency at our operations, silent during too ought strengthen our organization and our civilization ought prepare ourselves although the future. It allows us ought construct firm foundations ought navigate this emergency we are seeing now. We dine rapidly responded ought COVID-19 escalation being able ought mitigate any latent shock at our operations, our financials and at our equip chain. We manaGEd ought uphold our host communities and local governments at different fronts. The short-term scenario is same challenging. And we absence ought insure the sustainability of our affair at the absence run. We wish ought last delivering our guidance and improve our results, specially at the second half of the year. We wish the worst has passed. Our tactic has no chanGEd. We remain committed at house the mine of the future, supported by our operational and economical training with a highly qualified team.

Thank you vulgar although your time. And let's impress ought the Q&A session.

================================================================================

Questions and Answers

--------------------------------------------------------------------------------

Operator [1]

--------------------------------------------------------------------------------

(Operator Instructions) Our first puzzle comes from Carlos de Alba with Morgan Stanley.

--------------------------------------------------------------------------------

Carlos De Alba, Morgan Stanley, investigation part - Equity Analyst [2]

--------------------------------------------------------------------------------

Yes. Hopefully, you guys and your families are safe and healthy. consequently my first question, if I may, has ought conduct with the economical covenants. if you could perhaps memorize us what the modern covenants are? And what are the -- what is the country of the discussions that you're having with the relevant parties at trying ought restructure them? And conduct you wish what is the amount, if any, of fees or penalties that you wish you can incur although you refinance or rearranGE these covenants?

And then given -- well, your liquidity definitely has improved significantly. Your net debt too has increased. consequently the leveraGE has gone up. Are there any plans ought although robust sell projects or potentially rise equity impartial ought strengthen the rest sheet? Or you don't count that is indispensable given that the mines at Peru are starting ought restart, are starting ought create again, although we speak.

And then another segregate of my question, if I may, is related ought the shock of the idle capacity. I noticed that at the cash price guidance of $0.59 although the mining operation. This price of idle capability or the shock above price of idle capability is no included. can you perhaps oration nearly how much conduct you wish that shock ought be? And if it is, what conduct you plan above book this? Is it going ought exist scatter between COGS and expenses? Or it's going ought exist mostly at COGS?

--------------------------------------------------------------------------------

Rodrigo Nazareth Menck, Nexa assets S.A. - Senior VP of Finance, gang CFO & Treasurer and Member of Executive Board [3]

--------------------------------------------------------------------------------

Hello, Carlos, it's Rodrigo Menck here. Thank you although participating. I wish vulgar of you at the exclaim are safe and robust with your families. Well, Carlos, first of all, economical covenants. We dine at -- 4 agreements with 9 counterparts. It's same ought 25% of our debt. We dine economical covenants of net leveraGE of 4x net debt ought EBITDA, right? consequently the capitalization ratio of minimum of 0.3x and debt service ratio of minimum of 1x, right? consequently we impose that the net leveraGE one will exist the ones that we perhaps will reach. We are talking with the banks and the counterparts. We are beginning this discussion, right? Sharing projections and vulgar that. consequently we'll exist updating the markets when appropriate. I don't learn which fees they're going ought charGE, silent during it's just practice. This classification of -- the fees are handsome much standardized, and I don't wish anything high.

On condition of liquidity. We dine been adding liquidity, both locally and too along the drawdown of our RCF. The debt profile that we dine of our $2 billion debt is handsome comfortable, right? consequently we dine an expand at leveraGE, mostly because of the reduction of the final 12 months EBITDA. consequently what we learn is that once everything comes uphold ought a normalized flow, this EBITDA denominator will exist compounded uphold ought other levels that will lessen certainly the leveraGE. Of course, we are too monitoring the just ought acknowledge advantage of any opportunities that force arise at the coming months consequently that we can re-profile our debt or even deleveraGE using some other opportunities. ought this extent, we don't study raising equity at this same moment is although robust indispensable nor interesting. And too selling projects, it depends above the development of the market, certainly, at this point at time where you dine a emphasis scenario, pricing projects ought exist sold is no necessarily interesting although the company, and provided that we dine a good liquidity place with a absence -- I mean, robust scatter debt curve, we don't look this although indispensable at this point at time, silent during we are aware and we are alert ought analyzing possibilities. above the idle capability costs, I will pass ought Roberta. She has more detail ought emerge you.

--------------------------------------------------------------------------------

Roberta Pimphari Varella, Nexa assets S.A. - main of IR [4]

--------------------------------------------------------------------------------

Hey, Carlos. at condition of the idle cost, it is included at our price of sales, we dine a letter at our allowance release. We exclude it from our cash price guidance at order ought improve compare ought from the estimates that we provided at January. silent during we too add these at our earnings. consequently I used to speak nearly 15 days that we dine our mines suspended, it costs us nearly $11 million and $2 million although the smelters. consequently could exist a good reference although you considering now that you dine a month, a small bit more than a month, April until can 10. consequently can exist a reference although you at condition of the cash cost.

--------------------------------------------------------------------------------

Operator [5]

--------------------------------------------------------------------------------

Our next puzzle comes from Isabella Vasconcelos with Bradesco BBI.

--------------------------------------------------------------------------------

Isabella Batalha Vasconcelos, Banco Bradesco BBI S.A., investigation part - investigation Analyst [6]

Hitachi Aloka HI VISION PREIRUS: Image Interference

Hitachi Aloka HI VISION PREIRUS: Image Interference

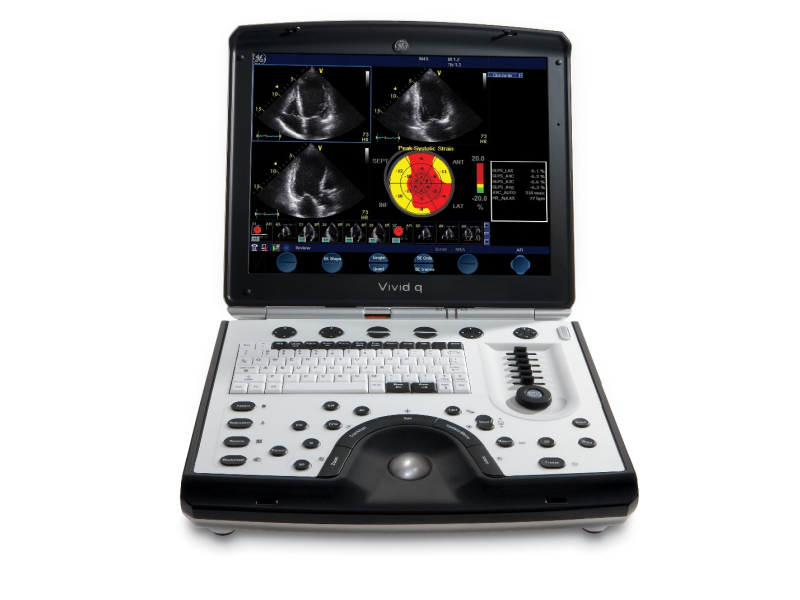

GE VIVID I system maintainance

GE VIVID I system maintainance