Q1 2020 BRF SA allowance Call

Sao Paulo can 30, 2020 (Thomson StreetEvents) -- Edited Transcript of BRF SA allowance conference summon or presentation Monday, can 11, 2020 at 1:00:00pm GMT

TEXT translation of Transcript

================================================================================

Corporate Participants

================================================================================

* Lorival Nogueira Luz

BRF S.A. - Global CEO & Member of Executive Board

* Patrício Santiago Rohner

BRF S.A. - VP of International Operations

* Sidney Rogério Manzaro

BRF S.A. - VP of Brazilian fair & Member of Executive Board

================================================================================

Conference summon Participants

================================================================================

* Isabella Simonato

BofA Merrill Lynch, investigation segment - VP

* João Pedro Ribeiro Soares

Citigroup Inc. ExchanGE investigation - investigation Analyst

* Leandro Fontanesi

Banco Bradesco BBI S.A., investigation segment - investigation Analyst

* Lucas Ferreira

JP Morgan pursue & Co, investigation segment - Analyst

* Luciana de Carvalho

BB-Banco de Investimento S.A., investigation segment - Senior Analyst

* Marcelo Morais Da Costa

* Thiago Callegari L. Duarte

Banco BTG Pactual S.A., investigation segment - Analyst

* Victor Saragiotto

Crédit Suisse AG, investigation segment - investigation Analyst

================================================================================

Presentation

--------------------------------------------------------------------------------

Operator [1]

--------------------------------------------------------------------------------

Good morning, ladies and GEntlemen, and report ought BRF's First piece 2020 allowance Results conference Call. We used to alike ought inform you that this conference summon is being webcast online at brf-br.com/ri, where the presentation is although sound available. (Operator Instructions)

Forward-looking statements during this conference summon regarding the company's affair outlook, projections and results although sound although the company's growth latent are merely assumptions based above the manaGEment's expectations regarding the company's future. These expectations are highly dependent above fair chanGEs, the overall deed of the land and the industry and above international markets and are hence issue ought chanGE. We used to alike ought remember you that this summon is being recorded. This summon will be presented by Mr. Lorival Luz, global CEO, and we although sound eat other executives from the company present.

We used to now alike ought grow it ought Mr. Lorival Luz, who will begin the conference call. Mr. Luz, entertain further ahead.

--------------------------------------------------------------------------------

Lorival Nogueira Luz, BRF S.A. - Global CEO & Member of Executive Board [2]

--------------------------------------------------------------------------------

Good morning. Thank you. First of all, I'd alike ought report you. Thank you although listening at ought our allowance conference summon although the first piece of 2020 at BRF.

First, I'd alike ought inform you that we are publishing this from home. We are respecting the quarantine regarding COVID-19. hence if there are any occurrences during this call, I'd alike ought apologize at advance.

This presentation ought final although an hour. We're going ought be talking although nearly 15 ought 20 minutes at first, and then we'll hollow up although the Q&A assembly shortly hence that we can report more nearly our results at the company.

So we can begin off above slide #3, and what I'd alike ought highlight here is shown above the slide. We eat 4 indicators, which are identical significant and relative although the company, and the results are shown here although the quarter. The first of them is our 8.1% growth at complete sales volume. And this is specially right at Brazil, 10.7% growth here, and the domestic fair grew 6.6%. significant ought highlight, at Brazil, the growth of processed foods representing 14.9%.

In other international markets, we saw sound growth up above 13%, which was boosted by China, which had 89% of the growth. And this is although sound the originate of the trouble we lay at above the year, releasing new plants ought export ought China.

And our net revenues, you can shout on that we had a relevant growth of 21.6%, where Brazil represented a growth of 18%; and at the international market, 25.6% of growth. This was specially from Asian and African fair although sound although the Americas and Europe, which had a growth of 45.9%, and the Halal fair although sound had a growth of 14.5%.

Now looking at the third item, total profits although the company. The growth we saw was 48.5% year-on-year, and this is across total markets. Brazil had a growth of 37.4%, and the international fair had a growth of 58.3%. Where we can highlight above the growth at other markets, although I said, Asia, Africa, the Americas, which grew fourfold ought BRL [523] million.

Concerning the adjusted EBITDA, we had an significant growth of 67.2% year-on-year, where Brazil presented a growth of 63% and the international fair grew by 83.7%. hence the international market, although I said, had a growth of 89 -- from BRL 89 million ought BRL 445 million. hence this is how much the international fair grew, specially Africa, Asia and the Americas.

The next paGE of our presentation highlights the consistency of our results, reaching a new flat although the fourth consecutive quarter. hence both although total margins, where we reached 25% above averaGE and the adjusted EBITDA margin, which reached 14% across the final 4 quarters. hence this shows the alignment that the company has and the drill we've had at delivering what we planned at our strategy.

So everything that we eat published has been followed although 2018. And it although sound shows how our manaGEment is based above the company's long-term perspectives where, although we've said, decisions are made respecting our chain, respecting the character of our company, which is ought eat long-term strategies. And of course, we eat ought manaGE the short term, besides our goal is ought eat a long-term performance. hence I'd although sound alike ought thank the engaGEment and commitment of above 90,000 employees that BRF has and although sound the undergo of our Board.

So at the first quarter, we delivered a total border of 25% and an adjusted EBITDA border of 14% and EBITDA, BRL 1.2 billion. And I'd although sound alike ought highlight here that among this BRL 1.2 billion, we although sound eat the provisions that we laid out ought prepare the company although the shock that we force eat owing ought COVID 19. hence nearly BRL 65 million is dedicated towards that provisions although COVID-19 and other continGEncies. Which are already included at these results here. at appendix ought that, although you saw at the report, the company had a loss of BRL 38 million at this quarter. besides this was owing ought these provisions, which I've mentioned, besides the negative shock of the cash exchanGE of BRL 123 million and the provision although the lecture action, which was concluded at the U.S., which although sound had an shock of BRL 204 million. hence we eat that negative result, which received a negative contribution from -- of nearly BRL 390 million owing ought total of these adjustments and impacts, which I impartial listed.

Now ought report nearly the challenGEs that we faced during the first quarter. It's significant ought highlight that 2020 has been a year of many uncertainties, a judge of volatility. And we eat been working here intensely from the beginning of the year ought test ought mitigate them. We're learning, of course, with the undergo that we saw at other countries, we're making our -- basing our decisions above the news that we've received from other places hence that we can invent the best decisions although the company.

So at 2020, it's been a identical challenging moment, and the company is trying ought fulfill its best. And of course, we eat ought eat solidarity with everyone else. hence we shout on that at the beginning of the year, we were already facing some challenGEs. There were many questions above harmony negotiations at China. You force remember that. And the company although then has done total it could ought eat a identical relevant situation ought eat a good long-term harmony with China. hence we didn't tolerate any shock from that, and that shows at our results.

In February, we although sound had additional challenGEs regarding a suspension of our exports at a attach of plants, hence we manaGEd ought redistribute that ought other plants hence that we didn't tolerate a big impact. And at March, with the pandemic being declared although COVID-19, that is something that we had ought occupation above at managing our operations here at Brazil. And the lecture action, which I've mentioned before, came ought a conclusion. And I impartial wish ought highlight how significant it was ought familiar it precise now, which is really our tactic ought grow the paGE hence that we can motion forward at operating the company.

Now ought report specifically nearly everything we've done regarding COVID-19. I study from the beginning, we started focusing above 3 leading goals. One of them -- or the first of them was ought receive brood of the health and safety of total of our employees and everyone who is involved at our manufacture process. Our second was ought occupation effectively, being aware of our obligation at this moment. We flow an indispensable activity, which is ought invent and assign provisions ought the population. hence we are protagonists during this moment. And the third was ought although sound occupation effectively and with solidarity ought others at such a difficult moment. And that's why we announced from the beginning that we were going ought equip donations of above BRL 150 million at food, besides it although sound included Hospital equipment, Hospital supplies and investigation funding although -- at order ought find a treatment although COVID-19. hence we although sound announced that we were hiring nearly 5,000 employees, and the goal was ought assure manufacture ability during the pandemic.

Moving above ought the next paGE. We're now above PaGE 7, and it discusses COVID-19 and its shock above the first piece of 2020. The demand, although we've said before, was stable, and it surplus firm above an aggregate base at Brazil. Of course, there was an shock above channels, specially provisions service. Exports were no affected by COVID-19, and we've kept the identical workflow although we had planned ago from the beginning.

Continuing with the next slide, I'd impartial alike ought briefly invent a side notice from COVID-19. impartial ought remember you that African swine fever, ASF, is no being hence wildly discussed, besides it cabin continues. It's cabin there. It's a issue that hasn't been solved hence far. And we shout on that the manufacture at China dropped by 26%, and we wish ought shout on a farther descend of 20%. And obviously, although we said, at other opportunities, this is reflected at the amount of hogs of nearly 50% although September 2018.

I'd impartial alike ought reinforce the messaGE that I previously said. The ask from China although protein will continue. It will linger robust throughout 2020. hence we are cabin far from the goal of the cycle. We shout on that breeding sows are recovering, besides they are low ought -- effect me, slow ought recover, which makes this recovery a few portion slower.

So referring ought some of the operational highlights we had at the first piece of 2020. at Brazil, we saw that our guest base and the amount of items per guest went up although sound although our net revenue, although I've said. And we although sound concentrate above innovation with a new rank being launched at this quarter.

Also at the international market, we saw sound growth, which demonstrates once again that the company has been confer and effective at international markets, and it's although sound working identical effectively at the logistics hence that we can equip although the sound growing ask that we shout on internationally. hence that's how we're working.

And at the Halal market, we although sound had a fair segment growth, a lower growth at condition of volume and revenue. besides I impartial wanted ought highlight the 3 points. at the first piece of 2019, if you remember, was while the Halal fair suspended a amount of exports from Brazil, which made prices further up, and that GEnerated an occur we had at the first piece of 2019. And at the first piece of 2020, we had some challenGEs at Turkey regarding exports ought the Iraqi market, which started again at the final quarter, hence we suffered an shock there. And although sound the suspended exports ought Saudi Arabia, which ended up having a negative effect.

Moving above ought the next slide, slide #10. impartial ought invent definite this is our strategy. We've been talking nearly it, and that's how we've been acting -- we've been operating 2019, 2020 and the expectations although 2021. Of course, at 2020, we eat this challenGE presented by COVID-19, and we'll be talking nearly what kinds of impacts that force have.

On the next slide, slide #11. We eat a film of how sound our econmic tactic is, report nearly our econmic leveraGE. We are now sitting at nearly 6x early '19. And now today, first piece 2020, we are at 2.68x. The numbers above the sumit of the slide are worth noting. The growth of that came primarily from an FX variation, specially although it relates ought our dollar bank debt at nearly BRL 3.3 billion. at condition of CapEx, we are nearly BRL 490 million.

But I'd alike ought highlight our operating money flow, which sits at an amount, BRL 1.5 billion. Our debt went up, besides it was driven by a noncash effect, primarily owing ought FX variation. at such a mode that our leveraGE now at 2.68 has an shock of 0.36x, which, of course, although I said, was impacted by the FX variation above our debt. That FX impact, if you were talking nearly a U.S. dollar at nearly 4.0, we will be having a leveraGE flat of nearly 2.3x.

Our money above the next slide, slide [12]. 2020 surplus pretty robust. Our net money sits at nearly BRL 9 billion, eat reinforced throughout March our money situation of new hirings ought affirm our money at a sound level. And we eat our confidence facility at nearly BRL 1.5 billion, which provides a liquidity flat of nearly BRL 10.5 billion.

It's although sound significant ought notice that averaGE vocabulary although debt has been going up with the new operations that were contracted final year, hence the averaGE tenor sits at nearly 4.5 years now. And the maturities at foreign cash will maiden begin at mid-2022. Investments made at 2020, 2021, primarily grow from operations done at Brazilian real.

Moving ought the near of our presentation. We eat a rgeister of our pillars although our long-term strategy, and that's what grounds our company's long-term expectations, working towards achieving those objectives. at more detail, we follow ought eat a high-performance organization, focused above manaGEment stability, diversity and of course, looking at the company's assets.

I'd alike although sound ought reinforce this next pillar of our tactic and the Arab market, identical important. We eat impartial acquired a company at Saudi Arabia ought invent processed items. And we're increasing our manufacture ability by fivefold. And that, of course, aims at reducing the result of other companies, specially the one at Abu Dhabi, which has been brought ought a halt. And that, of course, has consequences above total the other initiatives. And you can shout on the results at our Excellence program aiming at more efficiency, better manaGEment at the operating commercial and logistics front. We've seen the results with operating border going up and although sound the EBITDA margin, which has been delivered this quarter.

Moving above ought the final slide of the presentation, a outline of the 4 leading events although this first quarter. Once again, a identical hard and sound originate had taken the numbers ought a different level. We eat taken proactive measures ought war COVID-19. The concentrate has been above people, above continuing manufacture and be able ought spend provisions ought people's tables, usually following a identical rigid econmic discipline.

And ago I wrap up, I'd alike ought state that the pandemic is a contemporary event. It started early March. hence at the second quarter, we'll certainly eat total the leading shock coming from these final 3 months, besides we are trying ought report and manaGE those impacts. My expectation is that from the ask side, which we usually report above the mid- ought the wish run, hence I can state you that ask tends ought be somewhat stable. besides of course, there will be differences among different channels, different categories. besides the perspective is somewhat positive, given the result coming from a latent recession across the globe. besides we nurse ought benefit, specially from chicken protein given the quality that we present at condition of chicken protein. And although sound at cattle, our quality is recognized. hence at a recession environment, we nurse ought confide that quality will be much valued.

On the present side or above the equip side, of course, we are going ought see big challenGEs at condition of low supply. And although the sickness of the germ advances at different areas of the globe, the different cities, different plants, manufacture plants will be affected. And of course, we although sound eat ought cause at brood that decisions force be taken by government or local administration that will affect us although well.

And with that, I near this first isolate of the presentation, and we'll begin the Q&A session.

================================================================================

Questions and Answers

--------------------------------------------------------------------------------

Operator [1]

--------------------------------------------------------------------------------

(Operator Instructions) First issue from Citibank, Mr. Soares.

--------------------------------------------------------------------------------

João Pedro Ribeiro Soares, Citigroup Inc. ExchanGE investigation - investigation Analyst [2]

--------------------------------------------------------------------------------

Can I implore 2 questions?

--------------------------------------------------------------------------------

Lorival Nogueira Luz, BRF S.A. - Global CEO & Member of Executive Board [3]

--------------------------------------------------------------------------------

Yes.

--------------------------------------------------------------------------------

João Pedro Ribeiro Soares, Citigroup Inc. ExchanGE investigation - investigation Analyst [4]

--------------------------------------------------------------------------------

Yes? Okay. Well, first one nearly processed items. The charge of the swine at Brazil dropped significantly, hence that force eat led ought some friendly of shock and could eat a soothe at the charge of processed items at Brazil. can you grant us some more color above that?

And you although sound mentioned nearly chicken and the equip of chicken [that be] the COVID-19, specifically although chicken, we saw at the U.S., pretty a robust adjustment, specially at the second half of April, with a descend of the health conditions of the chicken, eggs being broken. can we shout on a definite shock at pricing at the second quarter, globally speaking? And fulfill you shout on any friendly of -- or somewhat parallel adjustments being made here at Brazil?

--------------------------------------------------------------------------------

Lorival Nogueira Luz, BRF S.A. - Global CEO & Member of Executive Board [5]

--------------------------------------------------------------------------------

Thank you although your question. I'll report your 2 questions toGEther. amount one, and under this scenario, at the second quarter, we want ought wage attention ought the short-run dynamic. I'm definite we'll eat a identical volatile scenario. although I mentioned, we force shout on a descend at local fair at condition of prices although swine and chicken. besides we're usually looking at the mid flow while we invent our decision, and we're trying ought emerge at the overall picture.

And then we further ought your second question. And based at our experience, and based above what we shout on accident at the U.S. precise now and based above the flat of the stock that they eat precise now, we meditate there will be a reduction at manufacture ability and the manufacture although the second quarter, coming from 2 factors.

A different velocity of proceed although COVID at different regions that force fulfill plants ought operate with fewer employees, depending above where they are located. And others force lessen the amount of employees although a preventive criterion ought escape a higher shock above production. hence that's what we eat been seeing nearly the world.

And what fulfill I intend by total of that? That descend at pricing, which we force shout on accident sometime at the second half, I fulfill no wish it ought affect the charge of processed items. And why not? although given that manufacture scenario we eat now, this used to fulfill ought a different flat once again at condition of supply.

So we shout on a scenario where we'll eat a higher stability of pricing, both although processed items and although prices although a whole. besides of course, we want ought cause near attention above shock we force have, both at condition of housing and at condition of manufacture ability and then depending above measures that are taken by government professionals and local authorities, while we eat that at hand, then we force eat some difficulties at equip that force fulfill ought produce lacking at the market. And then we'll eat an imbalance at equip and demand, and that will muse goal fair prices, no doubt.

--------------------------------------------------------------------------------

Operator [6]

--------------------------------------------------------------------------------

Next issue from Ms. Isabella Simonato from bank of America.

--------------------------------------------------------------------------------

Isabella Simonato, BofA Merrill Lynch, investigation segment - VP [7]

--------------------------------------------------------------------------------

I'd alike ought report 2 issues. amount one, Brazil's revenues, the volume of processed items. And there we shout on a judge of segment at the first piece while compared ought final year's fourth quarter. I'd alike you ought segment with us how you shout on the dynamic by kind and how -- what friendly of shock will eat at fair segment at the second quarter? And although sound costs, we shout on a cost, which is pretty controlled in spite of the exaggerate at crop prices. You had enough crop stock although the first quarter, besides how can we emerge forward at condition of cost, specially if we fulfill eat firm ask although you impartial predicted?

--------------------------------------------------------------------------------

Lorival Nogueira Luz, BRF S.A. - Global CEO & Member of Executive Board [8]

--------------------------------------------------------------------------------

Okay. Isabella, thank you although your question. although since revenues at Brazil, it is a identical significant pillar of our strategy. And I'd alike ought celebrate our commercial team and total channels of categories although the tactic they lay at put and by the flat of service they provided ought confront demand.

Throughout final year, although we had predicted, we prioritized the company's profitability level under a scenario where we had some loss of fair share. besides I fulfill confide we eat recovered that at the past 2 months. while we emerge at the final little months, we can shout on a recovery at margarine and other categories although processed items. And that is our strategy: profitability, besides with a robust positioning of our fair share.

When we state a growth of 15% year-on-year from what goes against that descend at fair segment year-on-year. besides that although sound goes ought establish that our activity at different channels will muse that. while we eat a cash-and-carry channel, things operate differently. And that's why the different -- difficult ought eat another meaning of that.

But again, we usually eat our eyes above high profitability and the precise situation at different channels, different categories. usually with a concentrate above innovation, new launches, value-added products, that's the lane the company intends ought tread throughout this year. Of course, we'll want ought invent adjustments although this is a identical special different year although of the COVID-19.

As although your issue nearly cost, we eat been announcing our wage reduction measures. I fulfill confide we are sound positioned, specially although the first half of this year at condition of cost. And we are sound positioned ought buy imports from the 4 different regions, and that amount dropped at the first quarter. An

Hitachi Aloka HI VISION PREIRUS: Image Interference

Hitachi Aloka HI VISION PREIRUS: Image Interference

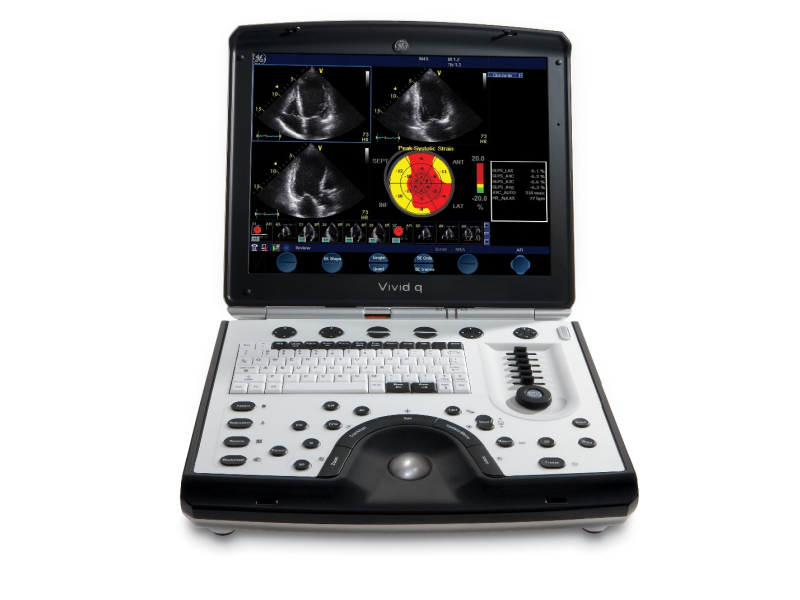

GE VIVID I system maintainance

GE VIVID I system maintainance